Using Binance Liquid Swap to earn every hour

- Rodney Alkins

- May 5, 2021

- 3 min read

Updated: Aug 13, 2021

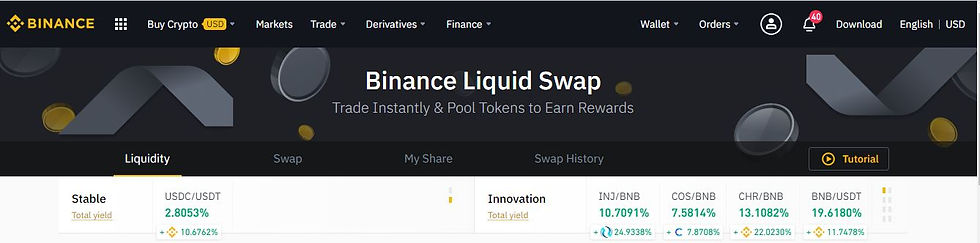

Binance's Liquid Swap facility is fantastic and a relatively easy way for any investor to make money. With Liquid Swap you can actually see in real time the money you are earning and how the value of the share you purchase is doing.

What Exactly is Liquid Swap?

Liquid Swap is a liquidity pool developed based on the AMM (Automatic Market Maker) principle. It consists of different liquidity pools, and each liquidity pool contains two digital tokens or fiat assets.

You can provide liquidity in the pools to become a liquidity provider and earn transaction fees and flexible interest.

Also, you can swap two digital tokens or fiat assets in the liquidity pools easily.

Liquidity Pools & Providers

Liquidity refers to how easily one asset can be converted into another asset, often a fiat currency, without affecting its market price. Before AMMs came into play, liquidity was a challenge for decentralized exchanges (DEXs) on Ethereum. As a new technology with a complicated interface, the number of buyers and sellers was small, which meant it was difficult to find enough people willing to trade on a regular basis. AMMs fix this problem of limited liquidity by creating liquidity pools and offering liquidity providers the incentive to supply these pools with assets. The more assets in a pool and the more liquidity the pool has, the easier trading becomes on decentralized exchanges.

On AMM platforms, instead of trading between buyers and sellers, users trade against a pool of tokens — a liquidity pool. At its core, a liquidity pool is a shared pot of tokens. Users supply liquidity pools with tokens and the price of the tokens in the pool is determined by a mathematical formula. By tweaking the formula, liquidity pools can be optimized for different purposes.

Anyone with an internet connection and in possession of any type of ERC-20 tokens can become a liquidity provider by supplying tokens to an AMM’s liquidity pool. Liquidity providers normally earn a fee for providing tokens to the pool. This fee is paid by traders who interact with the liquidity pool. Recently, liquidity providers have also been able to earn yield in the form of project tokens through what is known as “yield farming.”

Types of Liquid Swaps

Stable: Developed with a hybrid constant function automatic market-making system model to realize the transaction and pricing between two stable tokens, and provide a low slippage trading experience. The prices of the two tokens in the pool are affected more by exchange rate/token price fluctuations, and the market-making income is more stable than the Innovative products.

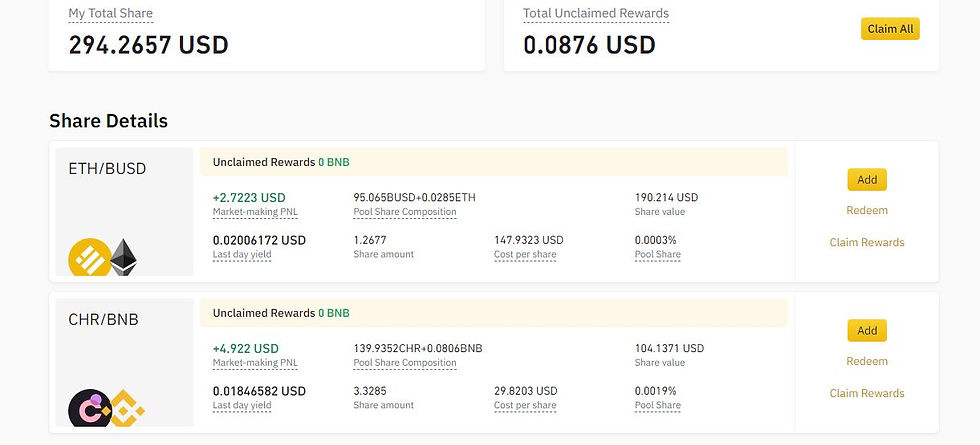

The photo above refers to a stable liquidity swap. You can see both BUSD and USDT which are both stable coins. In the photo it has "add USDT + BUSD selected" you can use that selection if you have that coin available if not choose add USDT or Add BUSD to add to the liquidity pool. when you buy in you will see something similar to the below photo.

The above photo shows a transaction using ETH only add in and a BNB only add in, but look at the pool share composition which would be the two coins that are being traded in the pool.

Innovative: Developed with a constant mean value automatic market-making system model to achieve transaction and pricing for two digital tokens or fiat currencies. The prices of the two tokens in the pool are affected by the exchange rate/token price fluctuations, and market-making returns fluctuate more greatly.

Is Liquid Swap a guaranteed investment?

No.

Possible losses may be caused by:

Fluctuations in token prices or fiat exchange rates, which will affect the value of shares. To further understand the risks, please refer to Impermanent Loss Explained.

When a large amount of a single token is added or redeemed, the value of the share will be affected and lost due to excessive slippage.

Frequently adding or redeeming tokens.

Liquid swap update: As you can see in my second above photo I was using the pair CHR/BNB but it started to go negative and I swapped it out for a larger pool of more popularly traded currencies ETH/DAI. This doesn't mean there is no risk but there is more opportunity than risk in the ETH/DAI pair. So far it has been a decent increase in share value over the last few days. Let us hope it remains upbeat as ETH continues to gain popularity with Bitcoin. Please have a look at the below video to know more about liquidity pools.

Final Take Away

If you are interested in engaging in this exciting investment facility reach out to me and let me assist you in getting started. Click Here to sign up with Binance if you do not have an account.

Comments